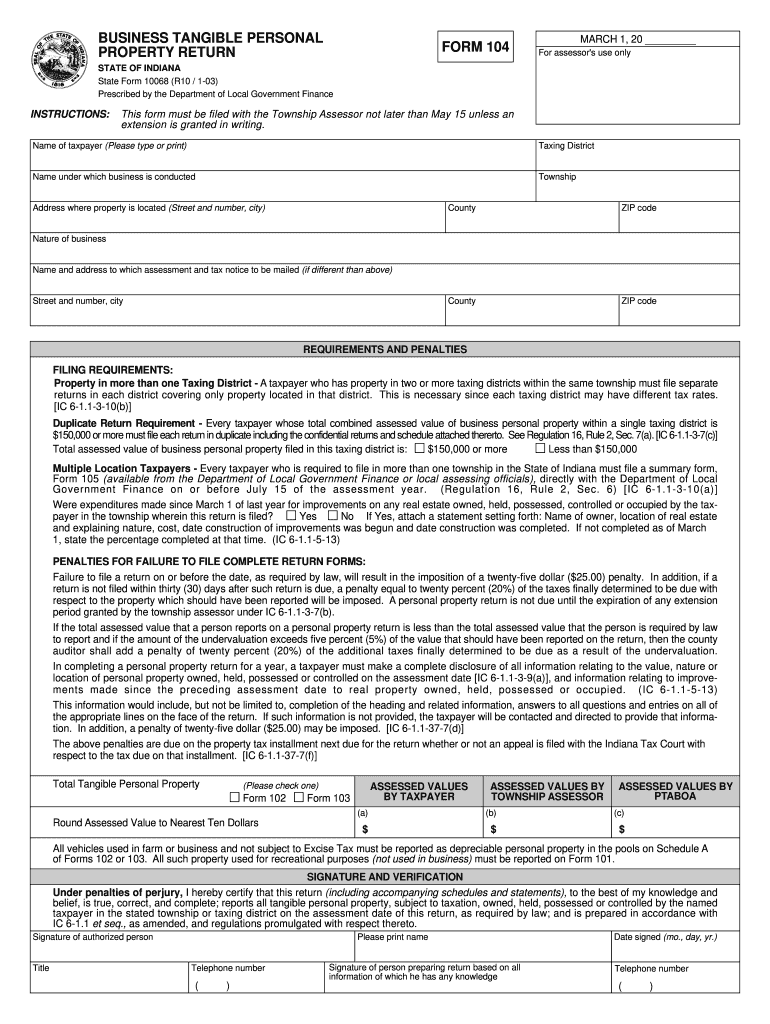

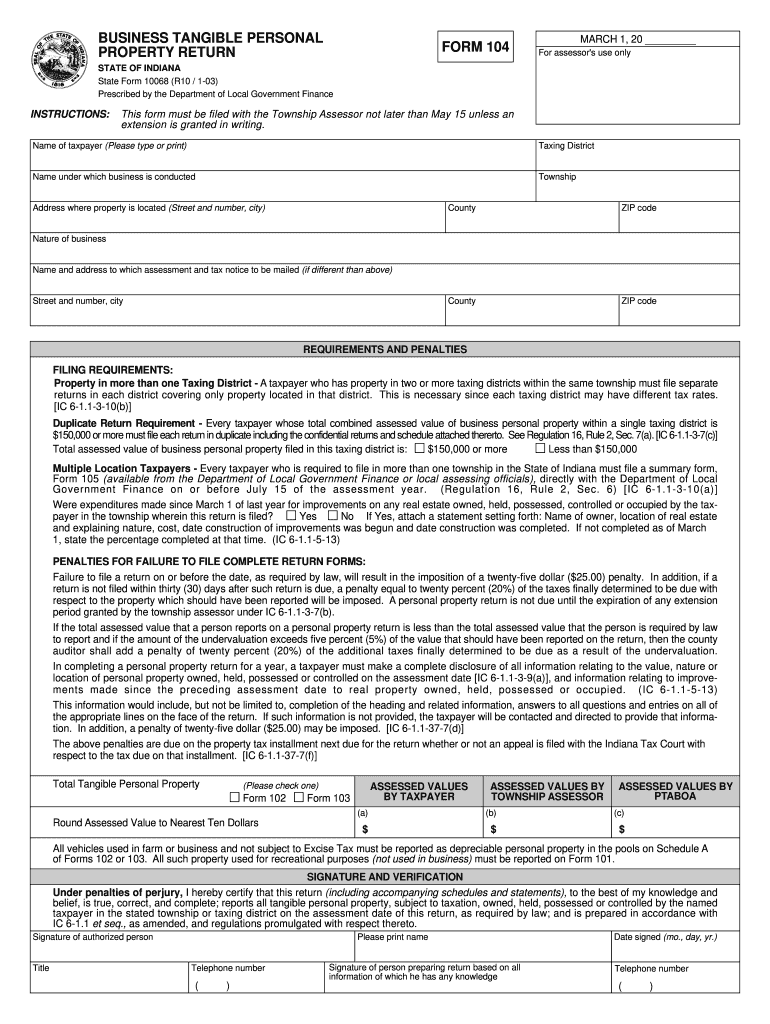

IN SF 10068 (Form 104) 2003 free printable template

Get, Create, Make and Sign

How to edit indiana form 104 online

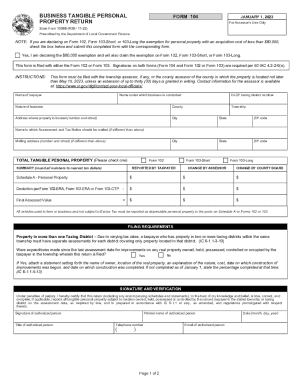

IN SF 10068 (Form 104) Form Versions

How to fill out indiana form 104 2003

How to fill out Indiana Form 104:

Who needs Indiana Form 104:

Video instructions and help with filling out and completing indiana form 104

Instructions and Help about indiana business tangible form 104

Welcome to the Alachua County property appraiser tangible Department we have created this presentation to assist you in filling out and filing your tangible personal property tax return also called form Dr dash 405 your tax return is due to the property appraiser's office no later than April first of each year late filed returns are subject to severe penalties and the loss of the tangible exemption which is up to 25,000 dollars of assessed value all businesses are required to file the tangible personal property tax return unless the filing requirement has been waived by the property appraiser to qualify for a waiver the business must file their return on time and have a just value of 25,000 dollars or fewer businesses that have been waived from filing are notified by postcard by February first of each year it is the responsibility of the business to file a tangible return if the just value increases above 25 thousand dollars in a given tax year tangible personal property includes everything other than real estate that is owned or used by the business tangible personal property includes but is not limited to furniture machinery and equipment signs leasehold improvements leased or loaned equipment and supplies equipment that is fully depreciated on the company's books but remains in possession of the business must be reported property that is personally owned but used in the business must also be reported additionally certain business owners especially heavy equipment contractors who own rent or lease equipment that require a class 94 license tag must report that equipment class 94 vehicles are those vehicles that function is tools themselves and require a specialized tag to move from one job site to another examples of class 94 vehicles include mobile cranes bucket trucks well drilling rigs and vacuum trucks if you are unsure whether your vehicle qualifies as a class 94 vehicle contact the property appraiser's office for clarification tagged vehicles are not considered tangible personal property however equipment attached to the vehicle to perform a service is considered tangible personal property examples include generators water tanks toolboxes ladder racks GPS trackers and storage tanks now we'll walk through filling out a typical tangible personal property returned and don't forget this return is due to the property appraiser by April first to avoid penalties for returning businesses the tangible account number and filing year will be listed all ready for new businesses the property appraiser will provide an account number for you and the filing year is simply the current year here you will enter the federal employer identification number if you know your North American industry classification system number enter it here enter your business name or DBA the corporation name and business mailing address if you need to make any changes or Corrections from the prior year please do so and indicate this on the form fill in sections one through...

Fill indiana form 104 fillable : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your indiana form 104 2003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.